| |

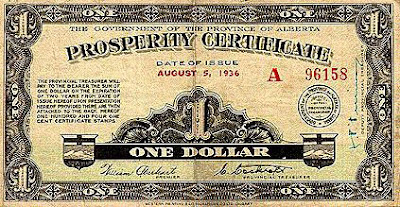

| Province of Alberta "Prosperity Certificate" c. 1936 |

In the early 1930s, Alberta radio evangelist "Bible" Bill Aberhart became a convert to the Social Credit monetary theory which stated that the cause of capitalism's ills was simply that people didn't have enough money to buy what they needed. The answer therefore was to simply print more money and give it to them. They'd then inject that money into the economy and the Great Depression would be vanquished - not with socialism but capitalism. In 1935, Aberhart's Social Credit Party won the Alberta Provincial election but when he tried issuing Prosperity Certificates like the one above, Ottawa immediately declared them illegal.

I've always thought there was a strong similarity between Keynesian and Social Credit economics. The former depends on the government to infuse cash directly into the economy through infrastructure spending while the latter depends on the government to infuse cash indirectly into the economy by printing more. Now that I think about it, there seems to be very little difference between prosperity certificates and food stamps - which are one of the most effective forms of stimulus available.

It's sort of strange then that these Conservatives, which grew out of the Preston Manning's Reform Party, seem to abhor stimulus, (only agreeing to a program when their government was threatened with non-confidence in January 2009). Especially when one considers how deeply the Social Credit Party of Alberta (led by Manning's father Ernest after Aberhart) were informed by it.

I'd never heard of those prosperity certificates... so I googled to learn more. What a fabulously impractical idea! All those wee stamps and the guy at the end of the spending gets the shaft... too funny.

ReplyDeleteYou made me learn something on a Saturday. Well done.

Glad to be of service!

ReplyDelete(Hopefully the takeaway was that the Alberta Mannings have always been a little loopy :)

I don't think this counts as Keynesian stimulus as all it does is increase inflation. Now, you could devalue your currency in this way to lower the cost of borrowing (like Greece wanted to do this year but couldn't due to not controlling the euro) but you run the risk of ending up like Weimar Germany. I think the Keynesian response of direct government spending and/or tax cuts is very different from the above run-around.

ReplyDeleteOh I agree, the comparison isn't ideal - but the two are two sides of a similar coin: using the financial clout of the government to jumpstart an economy. As for your point about the potential for a Weimar-like situation - I don't think it's a coincidence that the Keynesian model was widely adopted and social credit is a peculiar footnote in history :)

ReplyDeleteI like your characterization of social credit as a "run-around" - that's a great way to put it.